Tax Prep

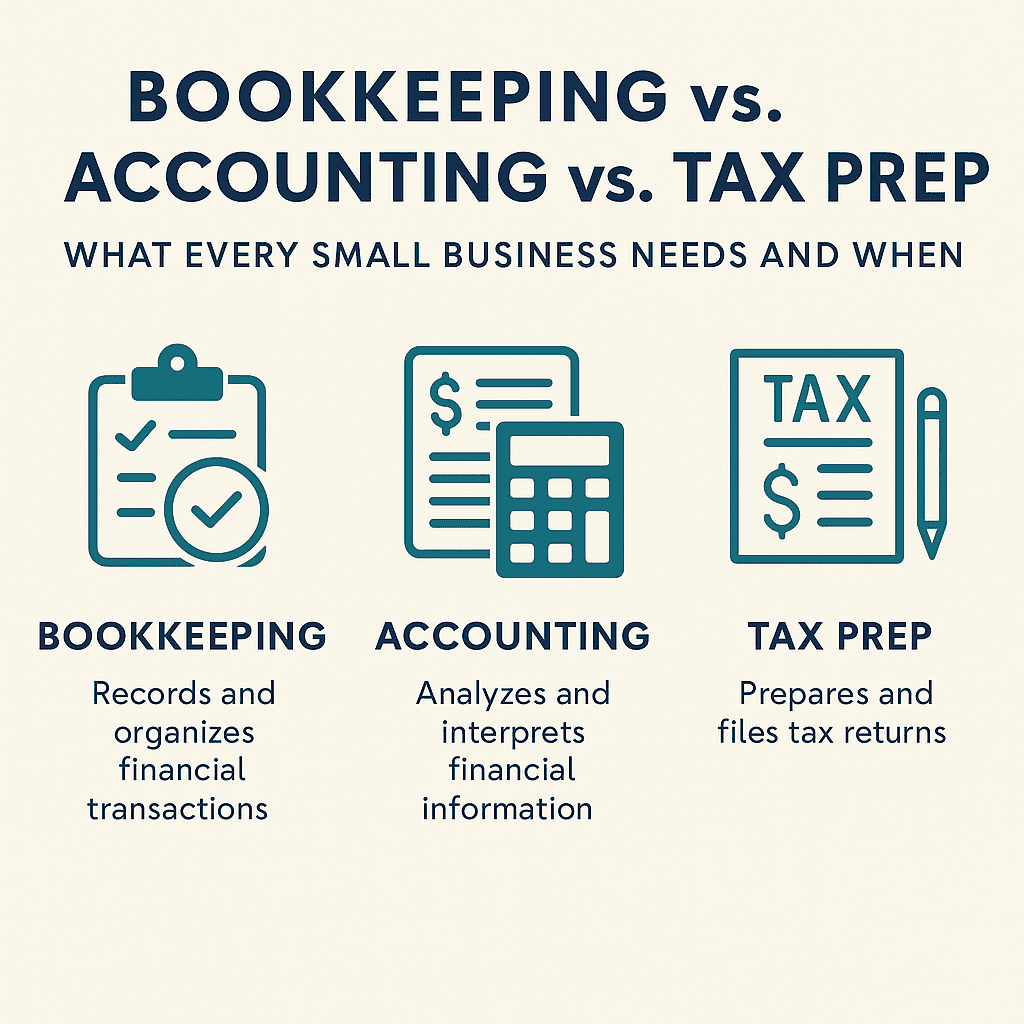

Bookkeeping vs. Accounting vs. Tax Prep: What Every Small Business Needs and When

What Small Businesses Need: Bookkeeping vs. Accounting vs. Tax Preparation Explained Running a small business means wearing a lot of hats — salesperson, manager, HR, and sometimes “accidental bookkeeper.” But when it comes to your finances, confusion about bookkeeping vs. accounting vs. tax preparation can get expensive fast. Do you just need someone to “do…

Read MoreWhat You Need to Know About the September 15 & October 15 Tax Extension Deadlines

The September 15 & October 15 Tax Extension Deadlines: Critical Info to Know As summer winds down, two important tax deadlines are quickly approaching: September 15 and October 15. If you filed for an extension earlier this year, these dates are critical for avoiding unnecessary penalties and keeping your tax situation in good standing. Let’s…

Read MoreHow is an LLC Taxed?

Understanding LLC Taxation: Pass-Through or Corporate Taxation? When you form a Limited Liability Company (LLC), one of the most important decisions you’ll face is how your business will be taxed. LLCs offer tremendous flexibility, allowing owners to choose between pass-through taxation and corporate taxation. Understanding these options is crucial to optimizing your tax strategy and…

Read MoreSpouse Forged Your Signature on a Tax Return? What Are Your Rights?

When Spousal Signatures on Tax Returns Become a Problem It’s not unusual for one spouse to sign a joint tax return on behalf of the other. While this isn’t technically proper procedure, the IRS typically accepts it without issue. However, serious complications can arise if one spouse later objects to their signature being forged—even by…

Read MoreWhat Type of Tax Professional Do I Need?

Choosing the Right Tax Expert Everyone should have their taxes prepared by a licensed individual who has had to prove competency, and you should be well aware of exactly what credentials and rights your tax preparer holds. So let’s take a quick look at the four types of preparers/representatives you will come across. Tax Preparer…

Read MoreOops, You Did It Again: The Most Common Mistakes People Make with Income Tax Planning (And How to Avoid Them)

The Most Expensive Tax Mistakes (And How to Avoid Them Before It’s Too Late) No one enjoys dealing with taxes. They’re complicated, time-consuming, and, let’s be honest, a little intimidating. But avoiding tax planning won’t make the problem go away—it will just make it more expensive. Every year, millions of people overpay their taxes or…

Read MoreCommon Tax Deductions Individuals May Be Missing

10 Most Common Tax Deductions Individuals May Be Missing in 2025 When it comes to tax season, many individuals leave money on the table by overlooking key deductions. While tax laws evolve, the core principles of maximizing deductions remain constant: you need to know what’s available and ensure you meet the requirements to claim them. …

Read MoreWhat Are the Tax Implications of Selling Your Home?

Understanding the Tax Implications of Selling Your Home Selling your home is a significant financial and emotional event. Whether you’re upgrading to a larger space, downsizing, or moving to a new area, it’s important to understand the tax implications that come with the sale. Taxes can impact how much of the sale proceeds you ultimately…

Read MoreThe Top Ten Tax Changes Small Businesses Are Facing in 2025

The Top Ten Tax Changes Small Businesses Are Facing in 2025 2025 is bringing a wave of tax changes, and small businesses are right in the middle of the action. From shifts in deductions to new incentives, there’s a lot to keep up with. But don’t worry—we’re here to break it all down in a…

Read MoreTop Ten Tax Code Changes for Individuals Expected in 2025

Upcoming and Immediate Tax Code Changes for 2025 As 2025 approaches, several significant changes to the U.S. tax code are set to impact individual taxpayers. These updates will affect everything from income tax brackets to retirement contributions. Staying informed is crucial for effective tax planning, so let’s dive into the top ten biggest tax changes…

Read More