The Hidden Tax Traps of Owning Rental Property (And How to Avoid Them)

The Hidden Tax Traps of Owning Rental Property (And How to Avoid Them) Owning rental property is often marketed as one of the best ways to build long-term wealth. Monthly cash flow, appreciation, and tax advantages all sound great on paper—and they can be. But in practice, many rental property owners unknowingly leave money on…

Read MoreAlabama’s Employer Childcare Tax Credit: A Smart Strategy for Businesses and Families

Alabama’s Employer Childcare Tax Credit: A Smart Strategy for Businesses and Families Running a business in today’s labor market comes with challenges that go far beyond payroll and profit margins. One of the most common struggles employees face—especially working parents—is reliable, affordable childcare. When that issue goes unresolved, it often shows up at work through…

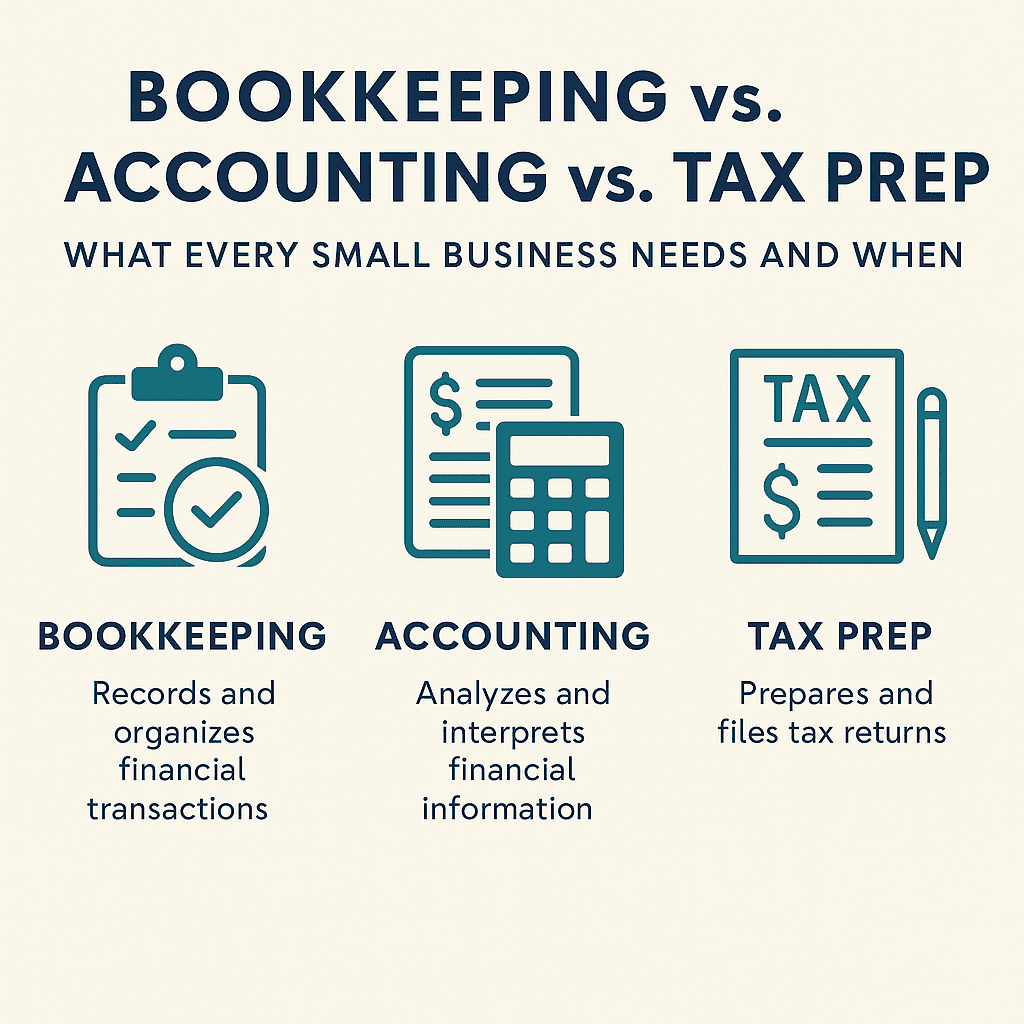

Read MoreBookkeeping vs. Accounting vs. Tax Prep: What Every Small Business Needs and When

What Small Businesses Need: Bookkeeping vs. Accounting vs. Tax Preparation Explained Running a small business means wearing a lot of hats — salesperson, manager, HR, and sometimes “accidental bookkeeper.” But when it comes to your finances, confusion about bookkeeping vs. accounting vs. tax preparation can get expensive fast. Do you just need someone to “do…

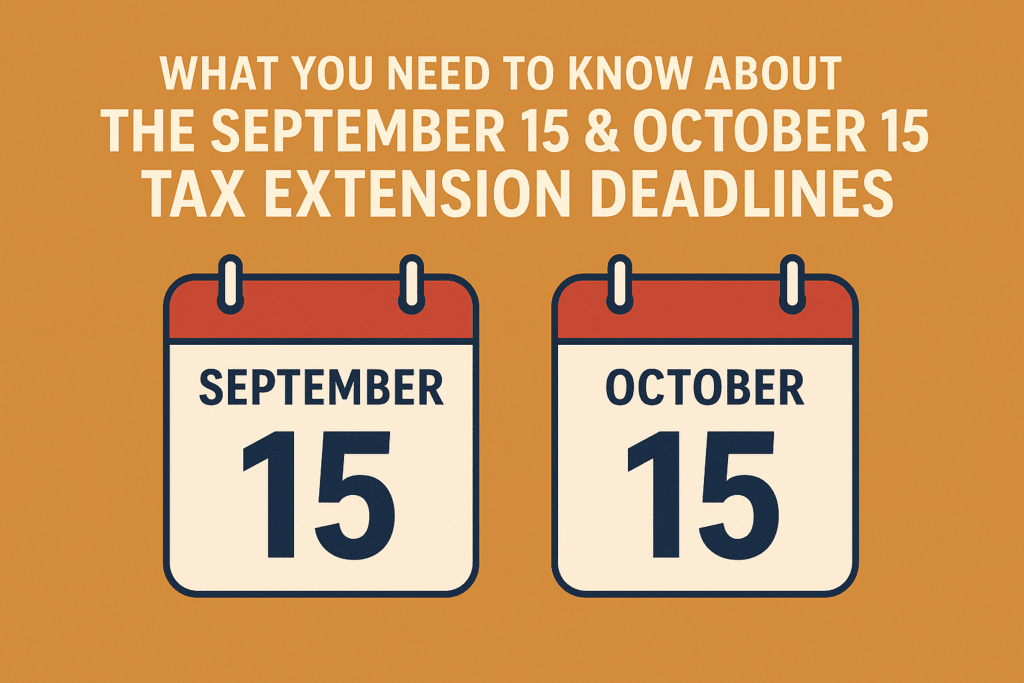

Read MoreWhat You Need to Know About the September 15 & October 15 Tax Extension Deadlines

The September 15 & October 15 Tax Extension Deadlines: Critical Info to Know As summer winds down, two important tax deadlines are quickly approaching: September 15 and October 15. If you filed for an extension earlier this year, these dates are critical for avoiding unnecessary penalties and keeping your tax situation in good standing. Let’s…

Read MoreYear-Round Services a Tax Pro Can Offer (That Save You Time, Money, and Stress)

Too many people think “tax” means April. In reality, the biggest savings and the smoothest operations happen because of what you do the other 11 months. Here’s a comprehensive guide to the services a modern tax firm like Azalea City Tax & Accounting provides all year to keep individuals and small businesses in control—financially, operationally,…

Read MoreCPA vs. EA: What’s the difference?

A Tale of Two Licenses Most of us have heard of a CPA, and we are aware that there is some lessor designation of ‘basic tax preparer’ like what you will find at an H&R Block, but what is this ‘EA’, these ‘enrolled agents’ we are finding more and more prevalent? Enrolled Agents Certified Public…

Read MoreDo I Need Professional Bookkeeping?

When Should You Hire a Professional Bookkeeper? Running a business, whether it’s a small startup or a thriving company, involves numerous responsibilities, one of which is maintaining accurate financial records. Bookkeeping, the process of recording daily financial transactions, is a critical aspect of managing any business. But when is it necessary to seek professional bookkeeping…

Read MoreC Corp Tax Strategies

C Corp Tax Strategies: Maximizing Benefits and Minimizing Liabilities Running a successful C Corporation (C Corp) involves not only navigating the complexities of business operations but also making strategic decisions to optimize your tax situation. C Corps have unique tax considerations that can significantly impact your bottom line. Understanding and implementing effective tax strategies can…

Read MoreHow is an LLC Taxed?

Understanding LLC Taxation: Pass-Through or Corporate Taxation? When you form a Limited Liability Company (LLC), one of the most important decisions you’ll face is how your business will be taxed. LLCs offer tremendous flexibility, allowing owners to choose between pass-through taxation and corporate taxation. Understanding these options is crucial to optimizing your tax strategy and…

Read MoreSpouse Forged Your Signature on a Tax Return? What Are Your Rights?

When Spousal Signatures on Tax Returns Become a Problem It’s not unusual for one spouse to sign a joint tax return on behalf of the other. While this isn’t technically proper procedure, the IRS typically accepts it without issue. However, serious complications can arise if one spouse later objects to their signature being forged—even by…

Read More