Bookkeeping

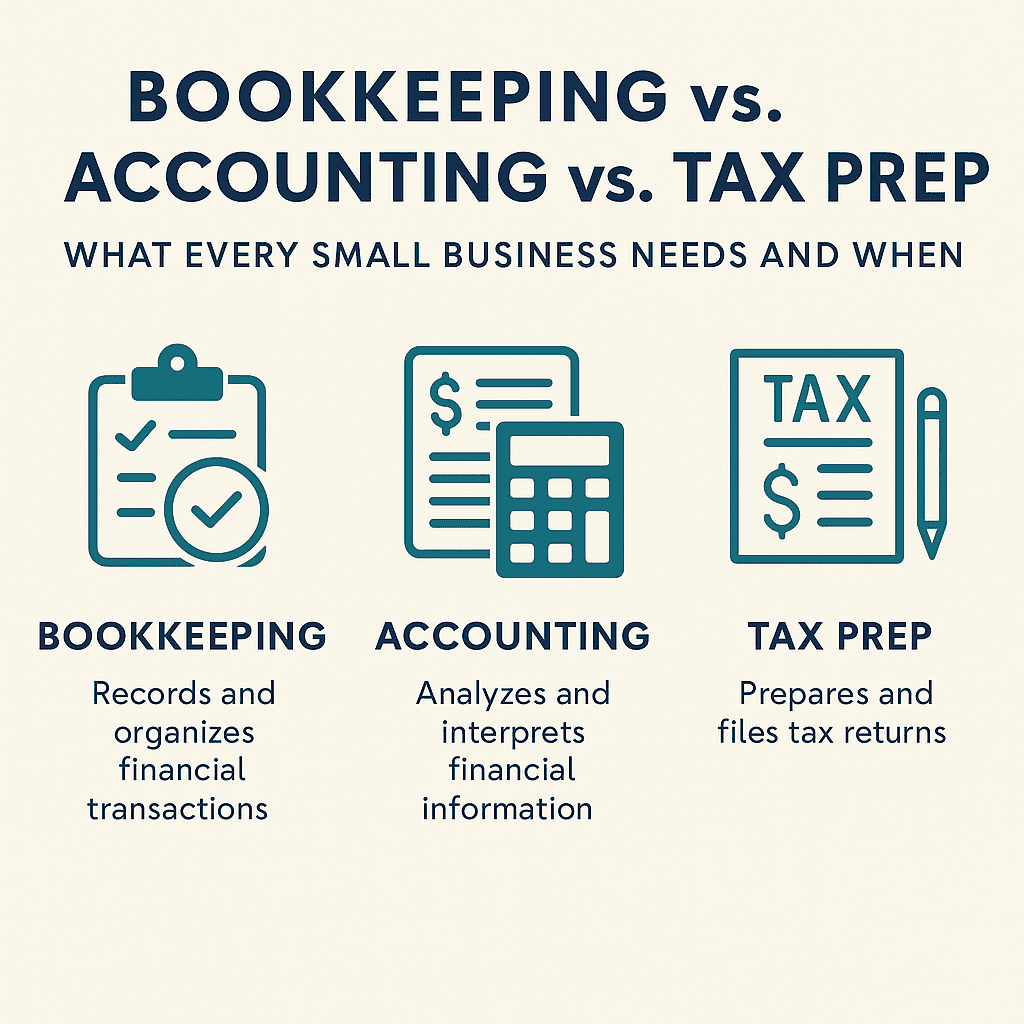

Bookkeeping vs. Accounting vs. Tax Prep: What Every Small Business Needs and When

What Small Businesses Need: Bookkeeping vs. Accounting vs. Tax Preparation Explained Running a small business means wearing a lot of hats — salesperson, manager, HR, and sometimes “accidental bookkeeper.” But when it comes to your finances, confusion about bookkeeping vs. accounting vs. tax preparation can get expensive fast. Do you just need someone to “do…

Read MoreDo I Need Professional Bookkeeping?

When Should You Hire a Professional Bookkeeper? Running a business, whether it’s a small startup or a thriving company, involves numerous responsibilities, one of which is maintaining accurate financial records. Bookkeeping, the process of recording daily financial transactions, is a critical aspect of managing any business. But when is it necessary to seek professional bookkeeping…

Read MoreWhat Type of Tax Professional Do I Need?

Choosing the Right Tax Expert Everyone should have their taxes prepared by a licensed individual who has had to prove competency, and you should be well aware of exactly what credentials and rights your tax preparer holds. So let’s take a quick look at the four types of preparers/representatives you will come across. Tax Preparer…

Read MoreIn Bookkeeping, Do All Deposits Count as Income?

Not All Deposits Are Created Equal: Understanding Income Classification in Bookkeeping Bookkeeping is an essential part of managing any business’s financial health. It involves tracking income, expenses, assets, and liabilities to ensure accurate financial reporting. One common question that often arises is: “Do all deposits count as income?” The answer is not as straightforward as…

Read MoreSelecting the Right Bookkeeper: Your Ultimate Guide to Finding the Best Bookkeeper

How to Select the Right Bookkeeper for Your Business Selecting the right bookkeeper for your business is crucial to maintaining financial health and achieving long-term success. A skilled bookkeeper ensures accurate financial records, manages cash flow, and helps you make informed decisions. However, with many options available, choosing the right bookkeeper can be daunting. Here’s…

Read MoreWhat is a 52/53 Week Tax Filer?

Understanding the 52/53-Week Tax Year: A Comprehensive Guide When it comes to accounting periods and fiscal years, most people are familiar with the standard calendar year, which runs from January 1 to December 31. However, businesses and some taxpayers have the option to use a 52/53-week tax year instead of the traditional calendar year. But…

Read MoreWhen Do I Need an Enrolled Agent?

Understanding the Role of an Enrolled Agent Navigating the complexities of the tax code can be daunting for both individuals and businesses. An Enrolled Agent (EA) is a tax professional authorized by the U.S. Department of the Treasury to represent taxpayers before the Internal Revenue Service (IRS). EAs specialize in tax-related matters and are equipped…

Read MoreWhen Do I Need a CPA?

Understanding the Role of a CPA Navigating the complexities of personal and business finances can be challenging, and there are times when professional assistance is invaluable. A Certified Public Accountant (CPA) is a trusted advisor who can provide a range of services beyond just tax preparation. But when exactly should you seek the help of…

Read More