Understanding the Tax Consequences of Selling Investment Properties

How to Minimize Taxes with Smart Planning and Avoid Costly Surprises

Selling an investment property can be a profitable milestone, but it also comes with a host of tax considerations that can surprise even experienced investors. Whether you own a rental house, a commercial building, or land that has appreciated over time, understanding how taxes work when you sell is critical. And if you’ve claimed depreciation on the property—or even accelerated depreciation through cost segregation—then the stakes are even higher.

Let’s break down the key tax consequences, how depreciation recapture works, how to use tools like 1031 exchanges to avoid big tax bills, and why your exit strategy should guide your tax strategy from day one.

- The Basics: Capital Gains Taxes When Selling Property

- What is Depreciation Recapture?

- Why Cost Segregation Can Backfire Without Long-Term Planning

- How to Avoid or Defer the Taxes: 1031 Like-Kind Exchanges

- Long-Term Strategy: Start With the End in Mind

- Other Considerations

- Final Thoughts: Strategic Planning Pays Off

- Frequently Asked Questions

The Basics: Capital Gains Taxes When Selling Property

When you sell a property for more than your adjusted basis (what you paid for it, plus improvements, minus depreciation), the IRS considers the difference a capital gain. Depending on how long you’ve held the property, this gain is either:

-

Short-term capital gain (held less than one year): taxed as ordinary income (up to 37%)

-

Long-term capital gain (held more than one year): taxed at 0%, 15%, or 20%, depending on your income

But it doesn’t end there—especially if you’ve taken depreciation deductions over the years.

What is Depreciation Recapture?

Depreciation is a fantastic tax tool while you own a property—it allows you to reduce your taxable income each year. But when you sell, the IRS comes back to "recapture" those tax benefits.

Depreciation recapture is the process by which the IRS taxes the portion of your gain attributable to prior depreciation deductions. The rate is up to 25%, and it applies to all depreciation claimed, including bonus depreciation or accelerated depreciation through cost segregation studies.

Example:

Let’s say you bought a property for $500,000, depreciated $100,000 over several years, and then sold it for $600,000.

-

Adjusted basis = $500,000 - $100,000 = $400,000

-

Capital gain = $600,000 - $400,000 = $200,000

-

Depreciation recapture = $100,000 (taxed at up to 25%)

-

Remaining capital gain = $100,000 (taxed at long-term capital gains rate)

This can be a huge surprise if you weren’t planning for it.

Why Cost Segregation Can Backfire Without Long-Term Planning

Cost segregation studies are popular among real estate investors because they allow you to accelerate depreciation by reclassifying parts of a building into shorter asset lives (5, 7, or 15 years instead of 27.5 or 39 years). That means bigger tax deductions up front.

However, if you sell the property early, you’re on the hook to recapture all those accelerated deductions—often at the higher 25% depreciation recapture rate. Not only can this wipe out the tax savings, but it may also push you into a higher bracket in the year of sale.

Moral of the Story:

If you’re not planning to hold the property at least 7–10 years, cost segregation might do more harm than good in the long run.

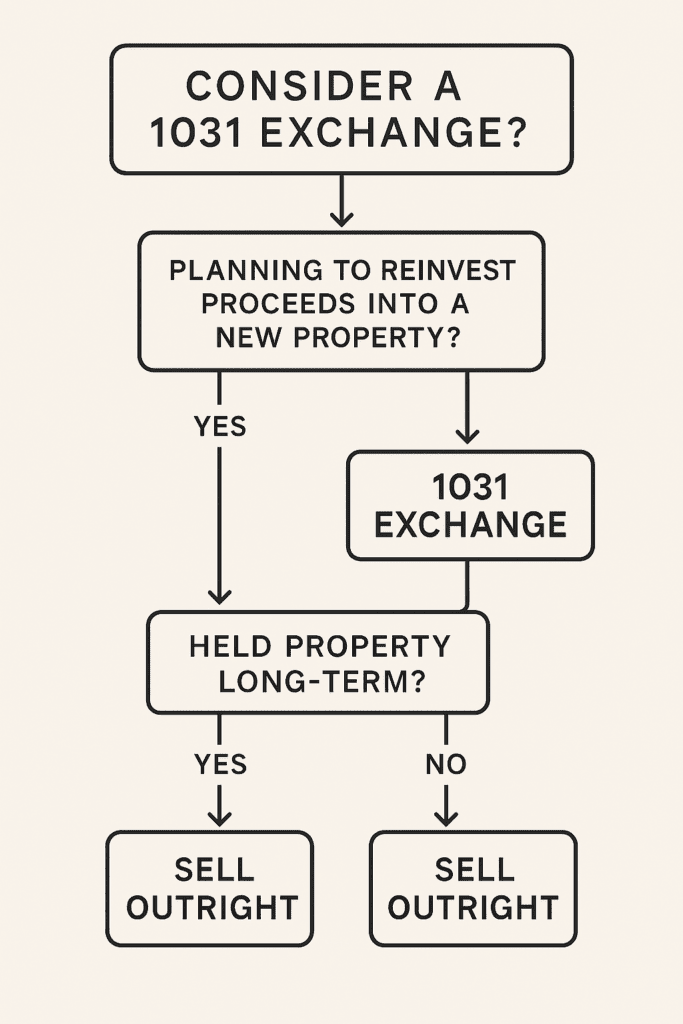

How to Avoid or Defer the Taxes: 1031 Like-Kind Exchanges

A powerful strategy to defer capital gains and depreciation recapture taxes is the 1031 exchange, named after Section 1031 of the Internal Revenue Code.

What is a 1031 Exchange?

A 1031 exchange allows you to defer all taxes on the sale of an investment or business-use property as long as you reinvest the proceeds into a similar (“like-kind”) property within a specific timeframe.

Key Rules:

-

Both old and new properties must be held for business or investment purposes

-

You have 45 days to identify the new property and 180 days to close

-

A qualified intermediary must handle the funds—you can’t touch the cash

-

You must reinvest all proceeds and replace debt to fully defer taxes

By rolling your gain into a new property, you avoid depreciation recapture for now—until you sell the replacement property without exchanging again.

Long-Term Strategy: Start With the End in Mind

If you want to build real wealth through real estate, you need to think beyond the purchase and into the exit—before you even sign the dotted line.

Here are some questions to ask:

-

How long do I realistically plan to hold this property?

-

Do I need short-term tax write-offs, or am I better off taking a slower, steadier approach?

-

Could I structure this investment to qualify for a 1031 exchange later?

-

If I do a cost segregation study, am I prepared to hold long enough to make it worthwhile?

Working with a qualified tax advisor or Enrolled Agent early on can help you design a plan that makes sense now and in the future. For example, sometimes it’s better to use straight-line depreciation if you anticipate selling within a few years, because it reduces the eventual recapture burden.

Other Considerations

Installment Sales

Spreading out payments over multiple years (if allowed) can break up your gain and potentially keep you in a lower tax bracket.

Opportunity Zones

If you reinvest in a qualified Opportunity Zone, you may be eligible to defer and potentially reduce capital gains.

Passive Losses

Suspended passive activity losses from prior years may become deductible in the year of sale, which can offset your gain.

Final Thoughts: Strategic Planning Pays Off

Taxes don’t have to eat away at your real estate profits. But smart planning is essential. By understanding depreciation recapture, knowing when and how to use 1031 exchanges, and carefully evaluating cost segregation strategies based on your timeline, you can avoid unpleasant surprises—and make the tax code work in your favor.

Real estate is one of the most tax-advantaged asset classes out there, but only for those who plan wisely.

Question: What is one of the most important things when selling investment properties?

Answer: The most important thing when selling investment properties is managing the taxes — especially capital gains tax.

How you sell, when you sell, and how you’ve owned or depreciated the property all affect how much tax you’ll owe. Structuring the sale right (for example, using a 1031 exchange to defer taxes) can save you thousands.

Question: What happens tax-wise when I sell an investment property?

Answer: When you sell an investment property for more than your adjusted basis (purchase price + improvements – depreciation), you have a capital gain. If you held the property more than one year, it’s taxed at the long-term capital gain rate (0%, 15% or 20%, depending on your income). If held less than one year, it’s taxed as ordinary income (up to 37%).

Question: What is a cost segregation study and how can it backfire?

Answer:A cost segregation study allows you to break out parts of the property (e.g., shorter-lived assets) and accelerate depreciation (5, 7 or 15 years vs. the usual 27.5 or 39 years).

The risk: If you sell early, you’ll have to recapture all those accelerated depreciation deductions — often meaning a large tax bill and possibly bumping you into a higher tax bracket.

Bottom line: If you’re not prepared to hold the property for 7-10+ years, cost segregation might end up hurting rather than helping.