CPA vs. EA: What’s the difference?

A Tale of Two Licenses

Most of us have heard of a CPA, and we are aware that there is some lessor designation of ‘basic tax preparer’ like what you will find at an H&R Block, but what is this 'EA', these 'enrolled agents' we are finding more and more prevalent?

Enrolled Agents

EAs are Enrolled Agents. They are federally licensed tax practitioners who may represent taxpayers before the IRS when it comes to collections, audits and appeals. As authorized by Department of Treasury’s Circular 230 regulations, EAs are granted unlimited practice rights to represent taxpayers before the IRS and are authorized to advise, represent, and prepare tax returns for individuals, partnerships, corporations, estates, trusts, and any entities with tax-reporting requirements. Enrolled Agents are the only federally licensed tax practitioners who specialize in taxation and have unlimited rights to represent taxpayers before the IRS.

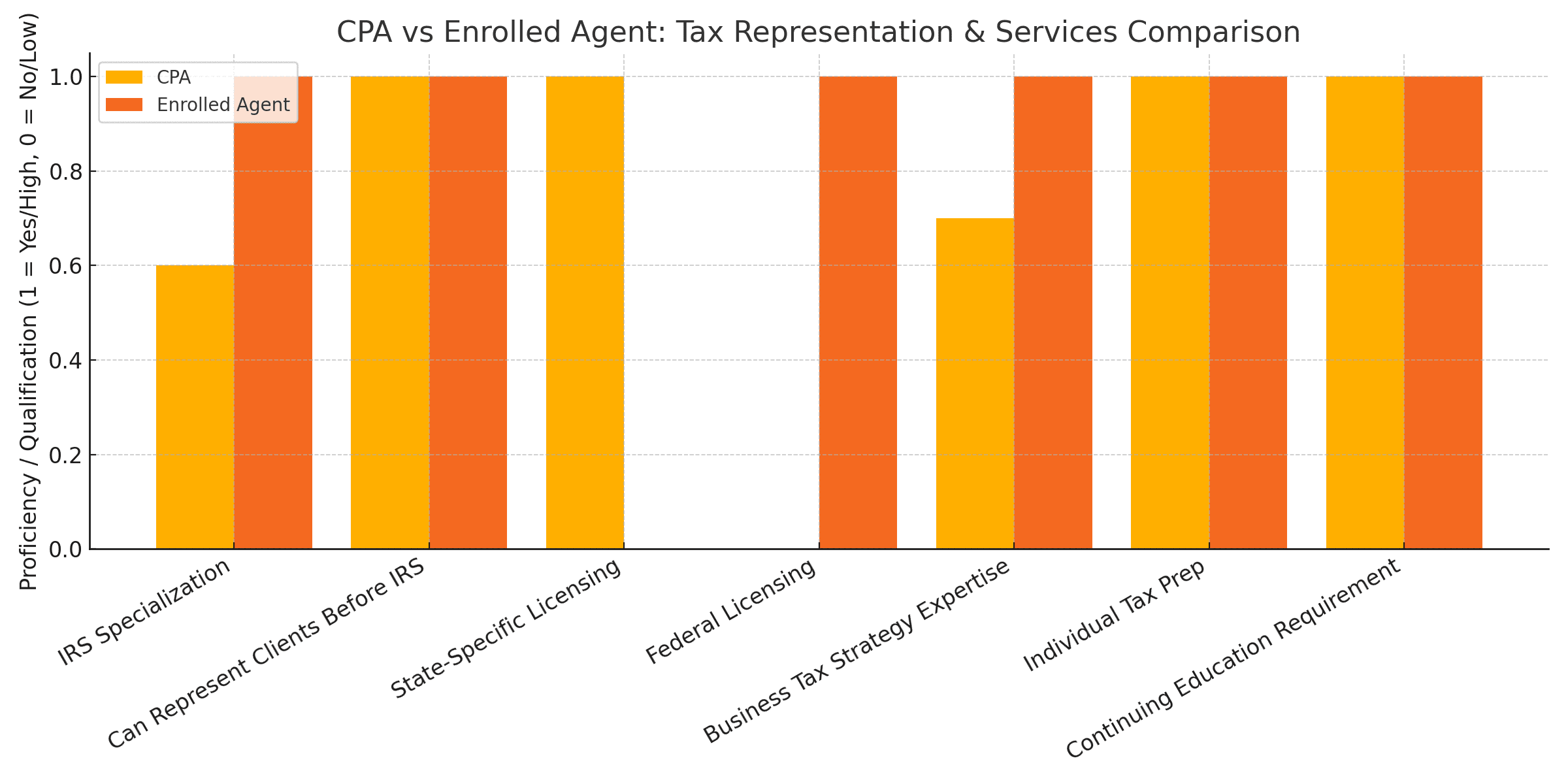

When it comes to tax preparation, EAs and CPAs both prepare business or individual returns as well as represent you in a federal audit. However, enrolled agents end up with a slight edge. Since certified public accountants are licensed through their state, when it comes to representing a taxpayer in a state audit a CPA can only do so in the state wherein they are licensed. An EA can represent a taxpayer in any state.

Additionally, while both enrolled agents and certified public accountants do continuing education, EAs are the only ones required to do continuing education specifically related to tax preparation and audit representation, thus helping EAs to stay better informed on the regular changes to tax laws.

Certified Public Accountants

Nevertheless, CPAs have their own edge. Being geared more toward auditing and other accounting practices certified public accountants are the only ones able to prepare audited or reviewed financials, and generally are who you would want to perform your company’s internal audits.

Unlike H&R Block’s basic tax preparers, both CPAs and EAs are required to pass licensing tests. EAs take a three-part test to prove proficiency in individual and business tax preparation as well as audit representation and knowledge of the tax laws. CPAs take a four-part test covering a wide range of accounting practices and tax law but are far less focused taxation.

So, Which is Better?

Neither is better, but rather they are two sides of the same coin. A taxpayer needs more than just a tax expert and more than just an accounting expert. Businesses and individuals need both the tax guru (EA) and the accounting guru (CPA). That’s why at our firm we have one of each: Christopher Olson, EA and Kenneth Germany, CPA, so you can enjoy the expertise of both.

Question: What is a common misconception about what CPAs actually do?

Answer: A common misconception about Certified Public Accountants (CPAs) is that they only prepare tax returns. In reality, CPAs do far more than tax work. They are licensed financial professionals who can provide a wide range of services — including auditing, business consulting, financial analysis, forensic accounting, and strategic planning. Many CPAs specialize in helping businesses make data-driven decisions, ensure compliance, and improve profitability.

Question: What is a common misconception about EAs?

Answer: A common misconception about Enrolled Agents (EAs) is that they only handle basic tax preparation.

In reality, EAs are federally licensed tax professionals authorized by the U.S. Department of the Treasury to represent taxpayers before the IRS in all matters — audits, collections, and appeals. They specialize in taxation, often more deeply than CPAs or attorneys, and must pass a rigorous three-part exam covering all aspects of federal tax law. Many EAs also provide year-round tax planning, business consulting, and compliance guidance to help clients minimize tax liabilities and stay in good standing with the IRS.

Question: What qualifications are required to become an EA?

Answer: To earn the EA designation, an individual must pass a comprehensive three-part exam that covers individual and business tax returns, or have relevant IRS experience. They must also undergo a background check and complete ongoing continuing education each year.